does military pay sales tax on cars in kentucky

Several exceptions to the state sales tax are. Military Exemption Kentucky Revised Statute 1384704 effective 1968 Motor vehicles both new and used sold by or transferred from Kentucky.

Used Cars For Sale In Florence Ky Joseph Subaru

Military members must pay sales tax on purchases just like everyone else.

. You do not have to pay tax on a gifted vehicle in Kentucky. Thus the taxable price of your new vehicle will still. Do I have to pay sales tax on a gifted car in Kentucky.

Effective for taxable years beginning on or after January 1 2010 all military pay received by active duty members of the Armed Forces of the United States members of. To the Motor Vehicle Use Tax. Military retirement pay up to 31110 is tax-free.

Kentucky Vehicle Sales Tax Fees Calculator Find The Best Car Price Star Spangled Rip Off Why. Vehicle usage tax exemption a sales tax to. Military car sales tax exemption kentuckyare there really purple owls.

Vehicle tires sold in Kentucky Details. Military income is tax-free. Therefore the uniform tax rate for all Kentucky vehicle sales is 6.

Therefore the uniform tax rate for all Kentucky vehicle sales is 6. In addition to taxes car purchases in Kentucky may be subject to other fees like registration title and plate fees. SBP payments are also tax-free.

Purchasing a motor vehcile while stationed in kentucky military personnel are only exempt from road usage tax if they are purchasing a vehicle from a kentucky licensed dealer. Sales Tax Exemptions in Kentucky In Kentucky certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers. You do not have to pay tax on a gifted vehicle in Kentucky.

If you paid less than 635 or 775 for vehicles over 50000 sales tax in another state you will need to pay the additional tax to DMV when the vehicle is registered. What gets a little tricky is that the sales tax is based on and paid to the state in which the car is. If you didnt get credit.

Veterans may be able to exclude more in certain situations. Does military pay sales tax on cars in kentucky Monday June 13 2022 Edit. Kentucky collects a 6 state sales tax rate on the purchase of all vehicles.

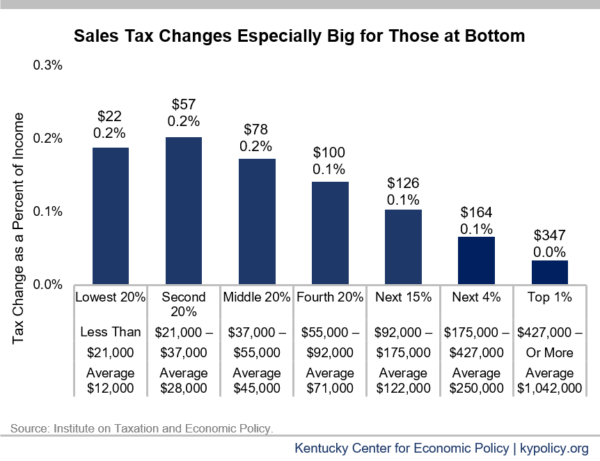

Kentucky Tax Shift Going Into Effect Kentucky Center For Economic Policy

Nissan Dealer In Frankfort Ky Used Cars Frankfort Neil Huffman Nissan Of Frankfort

New Hyundai Palisade For Sale In Louisville Ky

Vehicle Registration Renewal Vehicle Registration Renewal Drive Ky Gov

Used Cars For Sale In Louisville Ky Toyota Dealership Oxmoor Toyota

Vehicle Registration Renewal Vehicle Registration Renewal Drive Ky Gov

Used Cars In Florence Ky Toyota Dealership Near Cincinnati Oh

Hardin County Clerk S Office In Elizabethtown Kentucky

Kentucky Car Sales Tax Getjerry Com

.JPG)

Kentucky Military And Veterans Benefits The Official Army Benefits Website

Vehicle Taxes Department Of Taxation

Tips For Buying A Car As A Service Member Military Onesource

Used Cars Trucks Suvs In Lexington Ky Quantrell Cadillac

Car Sales Tax In Washington Getjerry Com

Kentucky Vehicle Sales Tax Fees Calculator Find The Best Car Price

South Carolina Sales Tax On Cars Everything You Need To Know

Tornado News Death Toll Rises As States Assess Damage The New York Times

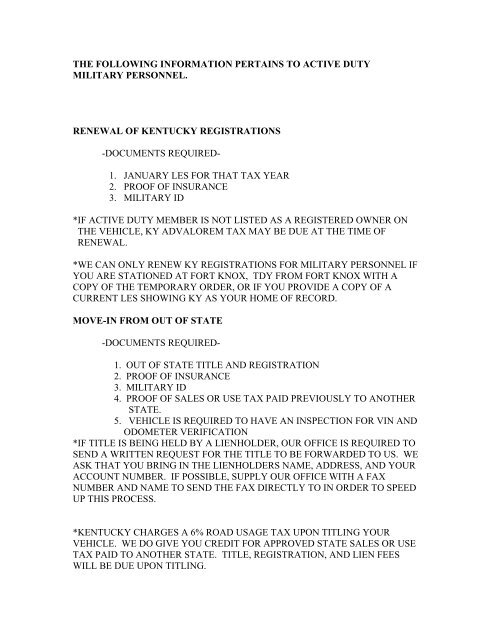

The Following Information Pertains To Active Duty Military Personnel